Why it still looks too early to buy the dip in tech

Nastco/iStock by using Getty Photographs

The nosedive in shares yesterday experienced heaps of the hallmarks of the type of wholesome shakeout strategists like to see get rid of the froth from the market place.

The Nasdaq 100 (NDX) (NASDAQ:QQQ) fell extra than 5% and the S&P 500 (SP500) (SPY) fell additional than 3.5%.

But eToro strategist Ben Laidler claims those looking to put income to function however will need to be selective.

“Investors are panicked by the Fed’s unparalleled double-barreled hiking cycle and balance sheet run off, and Lender of England’s stark ‘stagflation forecast of 10% inflation and recession by end of this calendar year in a G7 economy,” Laidler wrote in a take note Friday “Hazards are manifold throughout US, Europe, and China, even though valuations provide tiny all round aid nonetheless.”

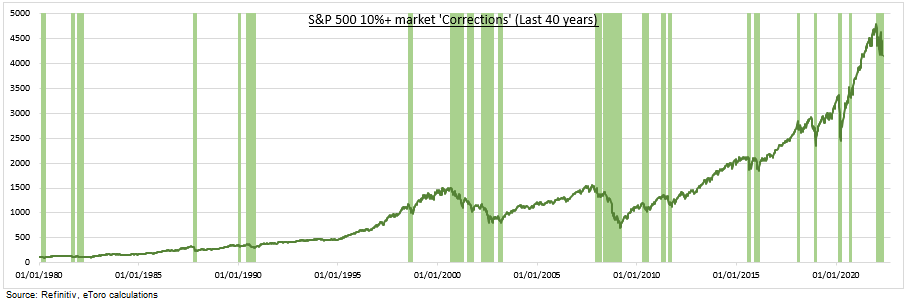

“But we see home for ‘less bad’ news from peaking 8.5% inflation and an already hawkish 3.5% rate cycle, with earnings resilient, sentiment pretty frustrated, and very good chance/reward to acquiring ‘corrections’ or ‘4% down-days’ above 12 months,” he stated.

“We strongly concentration on cheap Value and income-flow defensives. It is also early for tech.”

The S&P is off 14% from its significant coming into the yr.

“This is nearing the magnitude of the typical -17% ‘correction’ and has lasted more time,” Laidler reported. “The risk/reward to shopping for this standard correction above the pursuing 12-months is strongly good. Likewise, getting the rare (about as soon as each individual 18 months) significant ‘4%’ down working day we in close proximity to observed yesterday has a c20% normal 1-12 months return.”

The 10-calendar year Treasury yield (TBT) (TLT) is transferring larger this morning, up 2 basis details to 3.09%, but however off yesterday’s highs.

“Our ‘fair value’ P/E has more downside danger,” Laidler additional. “Bond yields will not rise forever, but we are in uncharted territory with Fed’s enormous harmony sheet roll off. By distinction earnings continue on to supply, up 10% in the US and 35% in Europe in Q1, and resilient to the macro maelstrom for now.”

“It is far too early for tech, right until bond yields peak. Following the 2000 ‘tech bubble’ Expansion lagged Benefit for 3 yrs.”

See Goldman Sachs’ picks for superior dividend growth and produce.