Nasdaq loses nearly 4%, hits fresh low for 2022

U.S. stocks fell sharply on Tuesday with shares selling off into the shut, as buyers dumped equities on fears of an economic slowdown.

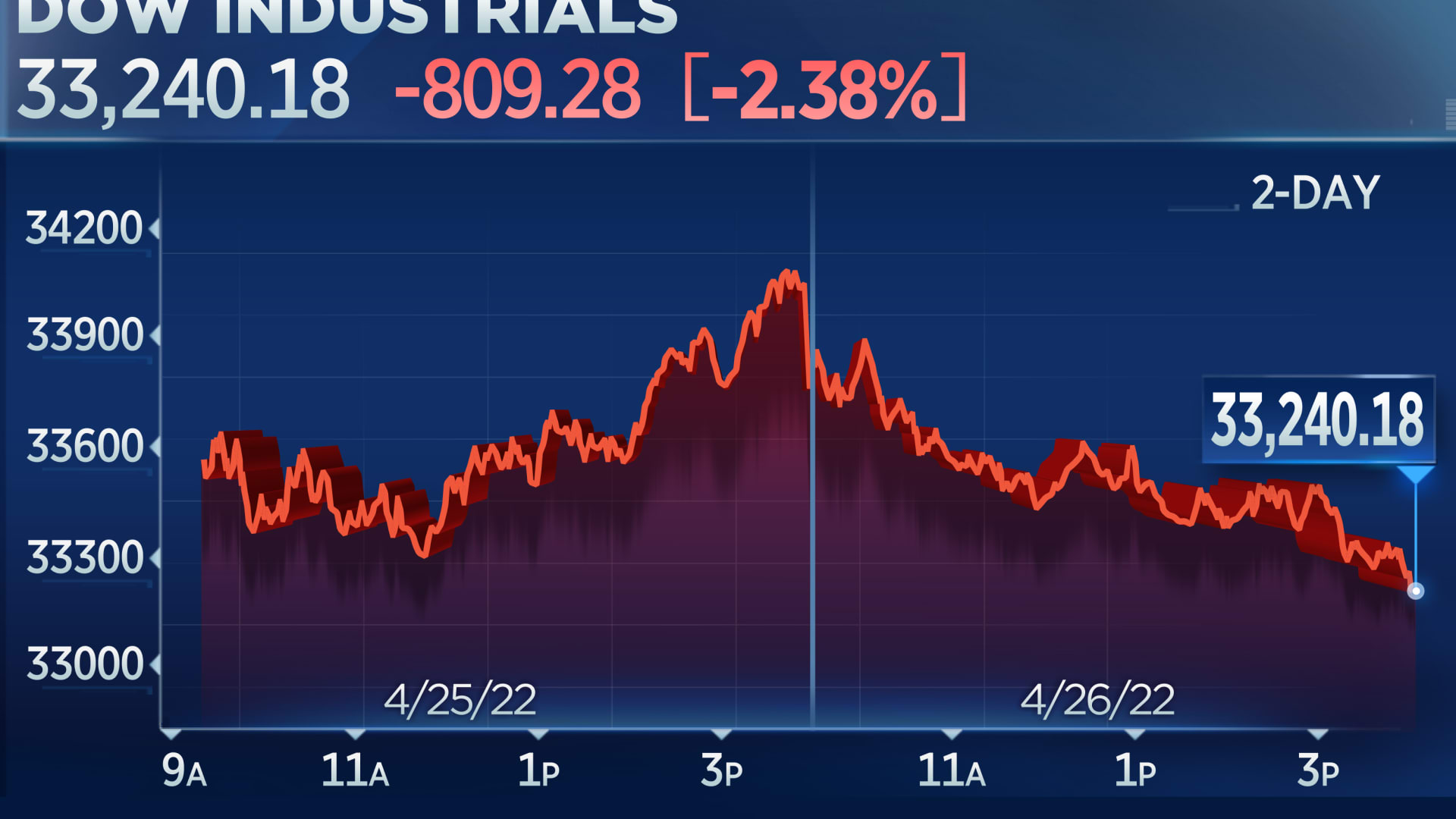

The tech-weighty Nasdaq Composite dropped 3.95% and hit a clean 52-week lower to close at 12,490.74. The index retreated even further into bear market place territory, sitting down now about 23% off its higher. The Dow Jones Industrial Average drop 809.28 factors, or 2.4%, to 33,240.18. The S&P 500 shed 2.8% at 4,175.20.

For April, the S&P 500 is off 7.8%. The Nasdaq is down 12.2%, and the Dow has declined 4.2%.

Tech shares led the decline Tuesday as buyers did not hold out around for Microsoft and Alphabet 1st-quarter success just after the bell, fearing extra blow-ups like the a single seen in Netflix before in the earnings year.

“The possibility-reward is just not there into massive-cap tech earnings,” Satori Fund founder and senior portfolio manager Dan Niles informed CNBC’s “TechCheck” on Tuesday. “I hope every single one one particular of them to see forward figures go down.”

Microsoft and Google guardian Alphabet equally saw shares close down far more than 3% forward of reporting earnings. Fb dad or mum Meta, Amazon and Apple also finished reduced Tuesday, with earnings success slated for later this week.

Netflix shares dropped almost 5.5% and strike a new multi-12 months minimal. Very last week, Netflix plunged 35% in a single day after reporting a surprising subscriber decline for the first quarter.

The energy in Major Tech stocks in current a long time “is probably to burst when fundamentals begin to meaningfully deteriorate as the general economic climate slows,” Wolfe Research’s Chris Senyek claimed in a study be aware.

Worries about the world-wide economy loomed. Investors are anxious about a Covid surge in China. About the war in Ukraine, a leading Russian formal explained the threat of nuclear war is serious. Additionally, substantial inflation in the U.S. is denting desire for merchandise from properties to sneakers.

“There are a great deal of economic growth fears,” claimed Peter Boockvar, main expenditure officer at Bleakley Advisory Team. “China is a large customer for U.S. tech. … The semiconductor marketplace does a large amount of business enterprise there. But it truly is also issues with advancement right here as effectively.”

Tesla, which has a manufacturing unit in Shanghai and counts China as a key market place for its electrical automobiles, was the most important laggard on the Nasdaq Composite, closing down about 12.2%. The shares also came below stress as its CEO and founder, Elon Musk, looked to near his proposed deal to acquire Twitter for $44 billion.

Chip shares ended up amid the prime decliners on the Nasdaq Composite. Nvidia missing 5.6%, and AMD retreated 6.1%.

Cyclical names tied to financial development also experienced Tuesday. Dow component 3M fell about 3% even with improved-than-predicted earnings as the corporation pointed out macroeconomic and geopolitical troubles in advance. UPS shares also slid virtually 3.5% in spite of the shipper’s quarterly earnings and income topping anticipations.

Other industrial names like General Electrical and Boeing were being lower Tuesday. GE fell 10.3%, even though Boeing eased 5%. GE warned that its 2022 outlook was “trending towards the small end of the vary.”

Bank stocks also struggled as curiosity prices fell. U.S. Treasury yields declined, with the benchmark 10-yr charge slipping underneath 2.8%. Wells Fargo dipped 2.7%, and Lender of The united states missing practically 2.3%.