Enterprise architecture tools could be acquisition targets

A new Gartner report on company architecture applications predicts that significant gamers in adjacent markets will invest in the solutions or start their very own owing to the growing great importance of products in modern-day small business.

Main distributors in regions these types of as solution and portfolio management (PPM) and IT service management (ITSM) could venture into company architecture (EA) tooling by partnerships or acquisitions, stated Akshay Jhawar, a Gartner associate principal analyst who co-authored Gartner’s 2020 Magic Quadrant for EA applications.

“Purchasers are seeking for much more built-in a single-cease remedies or platforms that can serve different regions, like solution and portfolio management, EA and innovation,” Jhawar stated.

In a different report on ITSM applications, Gartner observed that BMC, Ivanti and ServiceNow commanded 70{d11068cee6a5c14bc1230e191cd2ec553067ecb641ed9b4e647acef6cc316fdd} of the market share in 2019.

Company architecture applications adoption

Jhawar stated the adoption of company architecture applications is escalating as businesses advance their small business products to fulfill shifting purchaser requires, pursue electronic transformation and build a “composable company” applying interchangeable making blocks. He stated some EA groups mistakenly limit their scope to cataloging their existing IT devices, programs and systems when they really should get the option to seize their organization’s small business architecture and method.

Gartner’s latest Magic Quadrant on EA applications reflects a change to attributes that empower users to drag and fall objects and lessons, get context-sensitive aid, and use collaboration applications these types of as Microsoft Teams and Slack. Other crucial capabilities in numerous of the EA applications featured in the report contain guided navigation, autogenerated sights, good search and virtual assistant help, Jhawar stated.

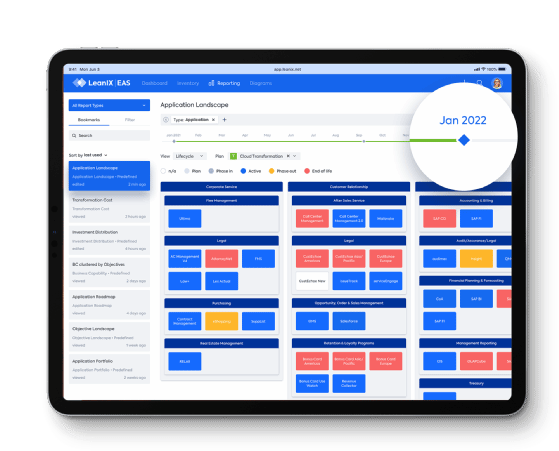

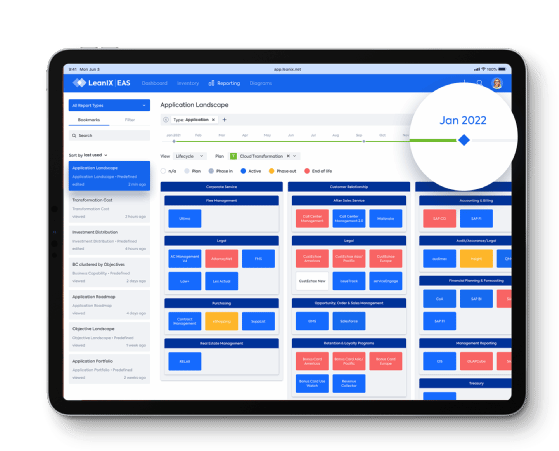

Avolution, Bizzdesign, Mega Global and Application AG “sustained excellence in both execution and vision” to hold their positions as leaders in the 2020 Magic Quadrant for EA applications, just as they had been in 2019, in accordance to the Gartner report. But Gartner now lists a lengthier group of challengers guiding them, with BOC Team, LeanIX, Orbus Application and QualiWare.

“These gamers typically have a regular, IT-centric vision for EA,” the Gartner report stated of the challengers, professing they are “not as aggressive” as the leaders and visionaries in pursuing small business method and shared functioning products.

4 EA distributors that Gartner identified as visionary are Ardoq, with a roadmap concentrating on automation, maintenance and representation applying algorithms and analytics Capsifi, offering versatility and scalability with graph analytics Company Architecture Alternatives, with an open source offering for unlimited users and very low-charge help service subscription and Planview, combining EA with portfolio management and company agile organizing.

Specialized niche gamers that Gartner identified in the EA Magic Quadrant are Clausmark, Erwin, Unicom Systems and ValueBlue.

Integration with company architecture applications

Jhawar stated distributors more and more have been integrating company architecture applications with solutions in adjacent groups, these types of as PPM and configuration management databases. He expects that development to continue in help of clients that need to tie with each other various aspects of the “patchwork quilt wanted to help the modern-day company.”

Gartner analysts evaluated EA applications throughout five use circumstances they see as essential to company architects and senior leadership. The use circumstances are as follow:

- seize, structure, examine and present products

- help change, transformation and optimization

- evaluate and regulate an evolving IT portfolio

- company architecture management and

- innovation.

To qualify for the Magic Quadrant, EA applications distributors experienced to have $eight million or much more for every calendar year in perpetual licensing income, $5 million in annual recurring SaaS subscription income, or 50{d11068cee6a5c14bc1230e191cd2ec553067ecb641ed9b4e647acef6cc316fdd} calendar year-above-calendar year income advancement for the previous a few decades. The distributors wanted to have an put in base of at least 50 generation clients applying their solution completely on an company-large foundation and at least 15 new clients in a few geographical regions in twelve months.