Amid privacy and security failures, digital IDs advance

Frustration about a expanding range of privateness and safety failures in recent years is driving the development of electronic identities controlled only by all those whose data they contain.

Regarded as “self-sovereign identities,” the electronic IDs will be used by shoppers, organizations, their personnel and governments about the up coming handful of years to verify every little thing from credit score worthiness and faculty diplomas to licenses and small business-to-small business qualifications.

“We are slowly and gradually graduating from crawling to strolling. It can take a person to two years ’til we have reliable capabilities to spark significant decentralized identity adoption,” said Homan Farahmand, a senior analysis director at Gartner. “A important non-technical hurdle is for companies to learn the strategy and get the necessary methods to appropriately adapt their small business procedures to decentralized identity ecosystems.”

A expanding range of companies is seeking to far better recognize decentralized identity know-how, which is predicated on blockchain electronic ledgers. Now, there are more evidence-of-strategy assignments than creation methods involving a compact range of companies. The pilots, being trialed in governing administration, monetary services, coverage, health care, vitality and production, don’t yet amount of money to an overall ecosystem, in accordance to Farahmand.

“While these assignments support identify gaps these as governance, user knowledge, standardization and interoperability issues, none of them [increase to the stage of] a simple decentralized ecosystem to bootstrap pervasive adoption at this issue,” Farahmand said.

What is a self-sovereign identity?

Self-sovereign identity envisions shoppers and organizations at some point getting handle of their identifying information on electronic devices and on the web, enabling them to provide validation of qualifications without having relying on a central repository, as is done now. Self-sovereign identity know-how also can take the reins away from the centralized ID repositories held by the social networks, banking institutions and governing administration businesses.

A person’s qualifications would be held in an encrypted electronic wallet for documenting trusted relationships with the governing administration, banks, employers, universities and other institutions. But it is vital to notice that self-sovereign ID methods are not self-certifying. The onus on whom to have confidence in is dependent on the other celebration. Whoever you current your electronic ID to has to make a decision no matter whether the qualifications in it are suitable.

“For example, If I apply for a job…, and they call for me to demonstrate I graduated from a particular school and have to have to see my diploma, I can current that in electronic variety.” said Ali. “And, most likely that credential would have to be cryptographically signed by the school that issued it. So the relying celebration – my place of operate – would have to make a decision when I current the credential if the signing important is a thing they have confidence in.”

For example, a place of employment could difficulty an electronic affirmation or “credential” that could be saved in that employee’s electronic wallet saying you operate for the XYZ Corporation. Even a thing as very simple as a health club membership verification could be included to a user’s wallet and offered by means of a mobile app.

For shoppers who are conscious of their on the web data – credit score card quantities, day of birth, once-a-year cash flow, and so on. – a blockchain-dependent community signifies the user controls who can see their data or get paying for approval without having releasing information these as their once-a-year cash flow or their age and deal with.

For organizations these as banks, rules these as know-your-client (KYC) regulations make blockchain-dependent electronic identities attractive.

How a self-sovereign ID works

A purchaser who needs a car or truck financial loan from an automobile dealership, for example, can give the supplier authorization by means of a general public important to validate that he or she has enough credit score or once-a-year cash flow to invest in a motor vehicle – without having revealing an correct greenback amount of money. So, for example, if the supplier needs to guarantee a purchaser earns more than $50,000 a yr, that’s all the blockchain ledger will validate (not that the individual basically earns, say, $seventy two,587 or some other correct determine).

The confidentiality approach is known as zero-awareness evidence (ZKP), a cryptography know-how that enables a user to demonstrate that cash, belongings or determining data exist without having revealing the information at the rear of it.

Who’s main the cost?

Self-sovereign identities lengthen to organizations or other companies that want to be able to verify – or be verified – for transactions with other organizations or governing administration businesses. For example, Ernst & Youthful has established a general public blockchain that allows companies use ZKPs to full small business transactions confidentially without having exposing delicate small business data.

In one more example, CULedger, a cooperative owned by dozens of credit score unions for the goal of giving back again-place of work services, labored with blockchain enterprise R3 to create CUPay, a safe electronic cash transfer (EFT) payment community that is crafted on R3’s Corda blockchain system. CUPay functions as an settlement rail for cross-border client payments.

The blockchain-dependent settlement process also functions as a dispersed identity system, enabling buyers to be verified by their credit score union and then get their electronic ID with them for use in cross-border payments, no make any difference what place they are in or what monetary institutions are concerned.

CUPay utilizes R3’s Corda for organizational identity and CULedger’s MyCUID, a particular electronic ID know-how established by means of a partnership with the Sovrin Basis and electronic ID enterprise Evernym. The solution provides built-in KYC and AML services and can be built-in into multiple networks, doing away with the have to have for guide entry of receiver information and giving crafted-in compliance management for credit score unions.

“So, the PoC they formulated was crafted to use the SWIFT payment rail, but they can use whatsoever rail they want, and it can even use a cryptocurrency to settle [a monetary transaction] if they have to have it to,” said Abbas Ali, R3’s head of identity management.

R3, established five years in the past by a consortium of main monetary services companies, heads up a team of more than 300 companies functioning to establish dispersed apps on top of Corda, their blockchain system. Third functions can build dApps (known as CorDapps), for use on the Corda system in any range of industries, together with monetary services, coverage and health care.

“In very simple phrases, you can consider of the [blockchain] system kind of like the functioning process. It provides all areas of identity on the community it provides a protocol for members to converse with each and every other, but that is as significantly as it goes. Any particular use situation or small business software on top of that would be dependent in the variety of a CorDapp,” Ali said.

“At the software stage, we have a great deal of companions establishing identity entry management answers employing what’s referred to as decentralized identity [DiD],” he included.

Credit rating unions are in the thick of it

CULedger’s CUPay removes the have to have for user names and passwords and relieves credit union phone facilities from the obligation of resetting them when a client loses them. The electronic identity, which is encrypted employing a general public important infrastructure (PKI), is controlled entirely by the credit score union client.

CUPay differs from modern-day payment rail methods in that a user’s identity is connected to each and every transaction they make. Existing methods, these as SWIFT’s settlement rail, don’t send the user’s identity with a wire transfer it stays separate from the wire instructions, indicating only the financial institution sending the income understands who is sending it.

“The benefit is for the obtaining celebration,” Ali said. “For them, this is just a person example of the use situation they formulated this PoC for, but they have a greater vision. They want people to have overall flexibility to shift in between distinctive suppliers. You have an identity on your telephone or, let us say your credit score union-issued software…. [If] you make a decision to transfer to a new state or place or improve credit score union service provider, you can get that identity with you. That is the greater use situation there.”

How CULedger’s MyCUID mobile app works: The image on the remaining shows a credit score union member being asked to verify their identity. The next image (correct) shows the member confirming it is in fact them. Experienced the member pressed “no,” the credit score union would be alerted that they may be working with be a undesirable actor or non-member.

The monetary services market as a total is targeted on establishing decentralized identity methods that would eliminate today’s strategy of determining buyers by holding their data in siloes controlled by a person enterprise or a federation of partner companies, Ali said.

Critical to a DID is that no a person entity or individual verifies a business’s or person’s identity. The onus for identification verification is on the relying celebration.

“Whoever you current your electronic identity to has to make a decision if the proofs you are presenting by means of the wallet are suitable,” Ali said. “What’s most vital is not what you say about your self but what a trusted organization says about you.”

That signifies a financial institution, governing administration, health care organization or any other entity verifying data about a self-sovereign identity user gets to be responsible for guaranteeing the data can be trusted.

Self-sovereign academic qualifications

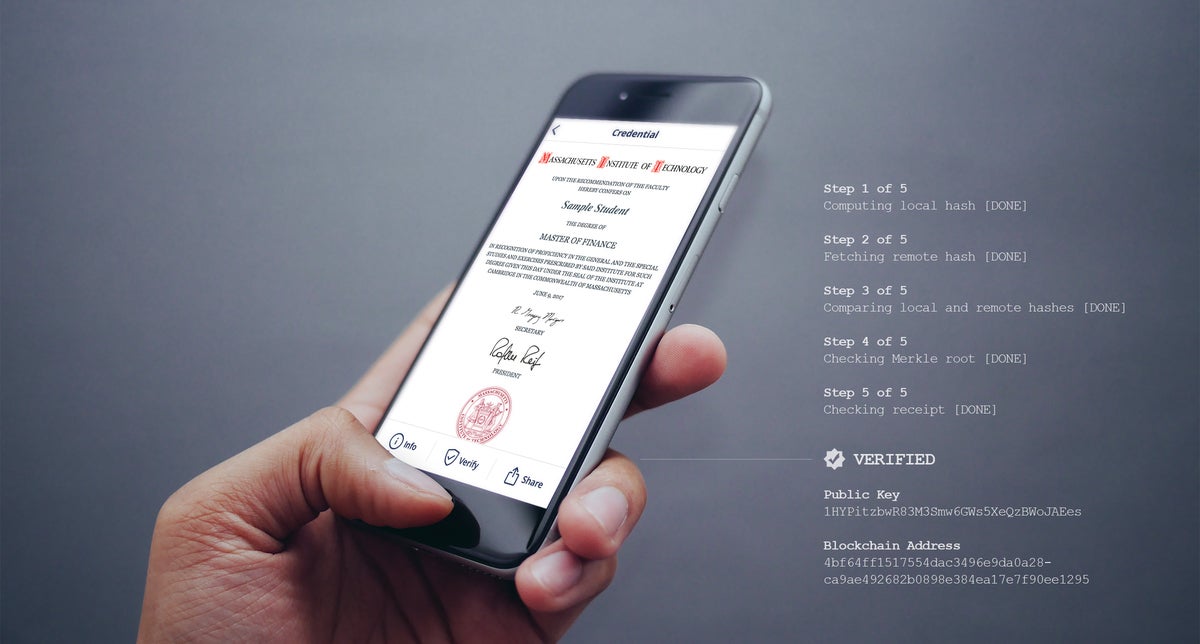

For example, in 2017, MIT commenced piloting Blockcerts, a blockchain-dependent community and software for storing and sharing academic qualifications. MIT labored with Electronic ID enterprise Understanding Equipment to build the software.

Right now, Blockcerts is up and operating and used by sixty nine{d11068cee6a5c14bc1230e191cd2ec553067ecb641ed9b4e647acef6cc316fdd} of graduates. In the previous graduating class of 3,718 college students, 2,561 opted to have their diplomas digitized and produced obtainable by means of the blockchain-dependent software, in accordance to Mary Callahan, MIT’s registrar.

Blockcerts makes a one electronic identity wallet a graduate can current by means of a url to would-be employers or other universities to verify academic achievements.

MIT

MITMIT’s Blockcerts mobile software retailers verified electronic diplomas that college students can share with probable employers or other universities.

“As you may picture, having… a piece of paper that signifies you graduated is a beneficial commodity in the world. So fraud was an difficulty,” Callahan said. “There’s also the chance to really realize a student’s lifelong understanding. For our college students, this is a person end together their understanding trajectory. They may perhaps be getting certificates, badges, masters levels, PhDs, and this can set them all collectively in a person very simple portfolio of their qualifications.”

MIT has aggressively marketed Blockcerts to college students by means of the school’s newspaper, display screen boards and the administrators of different academic departments – an effort that guide to a doubling of its uptake about the past yr, in accordance to Peter Hayes, assistant registrar at MIT.

“One detail we’re performing in phrases of outreach now is functioning with the career services place of work to raise the profile for probable employers. They host career fairs with 400 to 500 employers on campus,” Hayes said.

Very last yr by yourself, the Blockcert software was used four,124 instances to verify graduate qualifications, Hayes said. “So, while college students haven’t supplied us immediate comments, we can see … quantities [that] suggest they are employing it,” he said.

The movement is actual

The self-sovereign identity movement spans industries, in accordance to Gartner.

Illustrations of initiatives to make DID infrastructures involve: